Authors: Vincent Crave, Racha Fayad, Roxane Valfort

Date of publication: 10/01/2023

The Basics: SRM at a glance

Scientists in Life Sciences are encouraged nowadays to investigate biological events in more detail than ever, especially when it comes to projects with a therapeutic aim. There is a clear need to better understand the mechanism of action of drugs and to characterize the sub-cellular localization and interaction of molecules at a nano-level.

The development of new microscopy technologies, in particular super-resolution microscopy (SRM), has further facilitated these investigations. This growth of SRM use is confirmed by the increasing number of scientific publications mentioning the use of SRM: 100 publications in 2001 against 550 in 2019.

So far, SRM has exclusively been in the hands of experts in physics and optics, but the technology has evolved in recent years and manufacturers are now bringing to market simplified versions with the promise of putting SRM in the hands of biologists.

Science and Tech

The basic principle of optical microscopy relies on the capacity of a microscope to differentiate two points separated by a distance “d” called diffraction limit. In order to further understand cellular & molecular events at the nano-cellular level, a need to go beyond this diffraction limit (<120nm) emerged and was successfully reached by the development of SRM technologies in the 90’s. Lately, SRM has been identified as a crucial technology to better characterize the biology of therapeutical molecules or mediators such as cell therapy, exosomes, etc. before being tested on animals and humans.

The SRM Workflow

Microscopy in general, and more specifically SRM, require time, expertise and assay optimization, that will vary according to the technology adopted. The SRM workflow consists of three major steps that will be evaluated before the purchase of a technology: sample preparation, image acquisition, reconstruction and analysis.

Depending on the type of super-resolution technology, sample preparation can be costly and challenging when choosing the right fluorophore (conventional or specific) or preparing genetically modified strains with incorporated fluorescence tags on proteins of interest. The image acquisition steps will often remain time-consuming. The size and area scanned, as well as the number of stacks, will also be factors that must be assessed when calculating the acquisition time.

Image reconstruction and analysis are key to this process. The software provided with the device as well as the expertise of the user will tremendously affect the success of this step.

Types of SRM

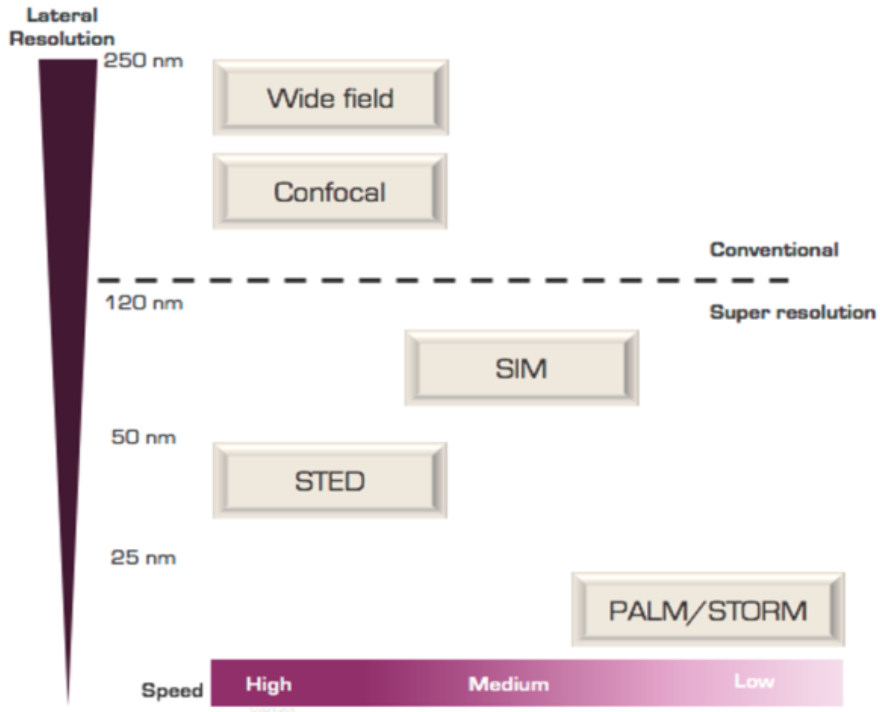

Three main types of SRM technologies have been developed and are primarily differentiated by their lateral resolution (10-120nm):

- SIM with the lowest lateral resolution (100 to 120 nm); mainly used in structural biology to observe organelles and complexes such as mitochondria, nuclear pore complexes, or cytoskeleton.

- STED (lateral resolution of 50 to 70nm); used in live-cell imaging to observe events like vesicles, microtubules, etc.

- PALM/STORM/F-PALM with the greatest lateral resolution of SRM ranging between 10 to 40 nm and used to precisely localize single molecules by switching on and off individual fluorescent molecules. For example, it provides information on single-molecule diffusion in the membrane.

The price of the instruments remains undoubtedly one of the major challenges of this technology. A device can range in price between € 150K and € 1.5 million, depending on the technologies and softwares implemented.

Who Currently Has the Tech?

University laboratories and core facilities are the main users of SRM, the majority of whom are already equipped or looking at acquiring SRM technology. Academic labs frequently use them for basic research to decipher the molecular interaction of proteins implicated in signaling pathways of interest.

In industry, all major pharmaceutical companies are working with confocals for various applications, including drug screening, extracellular vesicles and metabolism studies.

However, in the field of biotechnology, the needs for SRM vary and depend on the application. Analyses requiring this type of system are mostly outsourced for lack of time, equipment and/or specialists.

Market and Business Overview

Market Shares and Numbers

SRM is a subset of the microscopy market and represents approximately 40% of the overall microscopy market, with estimated market size of $2.5 billion in 2019. Market demand for SRM devices is expanding, with a Compound Annual Growth Rate (CAGR) of 11.7%—the market is estimated to grow to $5.6 billion in 2026.

Indeed, the growing need for life science research to study biological events at the molecular level, coupled with technological advances in engineering, are among the key factors driving the growth of this market. As a result, 41% of the SRM market is focused on life science applications.

Revenues in the life sciences SRM device market are estimated at $1.02 billion in 2019 and are expected, with a CAGR of 23%, to reach $2 billion in 2022. North America and Asia are the two largest shareholders and account for the largest share of these revenues (approximately $370 million each), followed by Europe with 19% at around $197 million.

Global Players and Up-and-Coming Actors

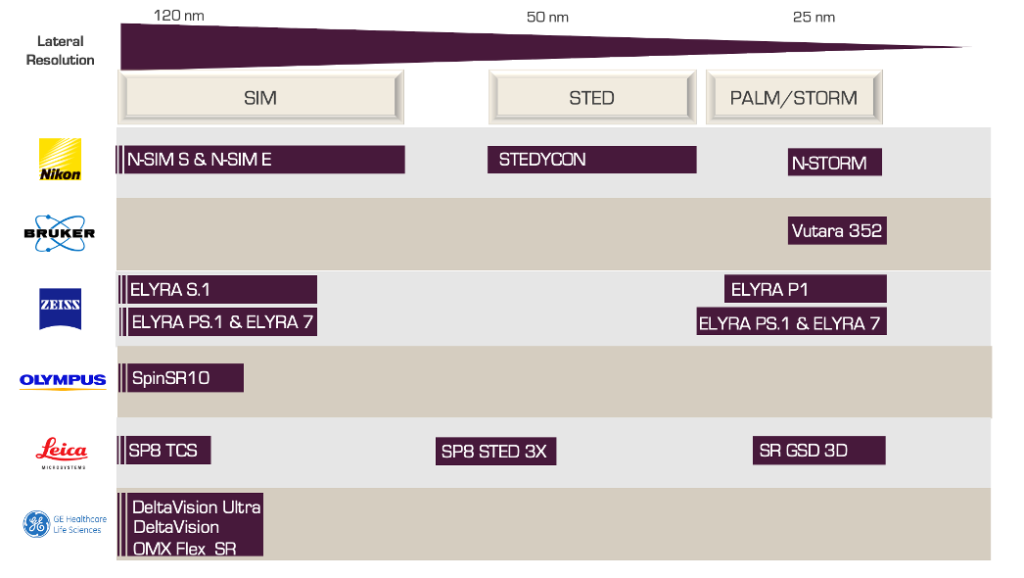

The SRM market is consolidated with 90 % of market shares divided between a few global players. As shown in Figure 2, the international players (Nikon, Olympus, Leica, etc.) offer a panel of SRM microscopes. They currently dominate the SRM market thanks to their reknown technical expertise, professional reputation in the field, and the value of their offer.

However, since 2010, a number of small players have emerged, mostly as spin-offs from universities. They are differentiating themselves by developing a new concept of benchtop, affordable, easy-to-use SRM microscopes. These new actors are signaling a clear shift towards simplified, accessible, and compact products with the aim of democratizing the access to SRM technologies.

Some of the players include British Oxford Nanoimaging (ONI), which was incorporated in 2016 based on the work of Professor Achillefs Kapanidis Research Group at Oxford University. Having raised a total of around £23 million, ONI is a pioneer of the new generation of compact super-resolution microscopes (Nanoimager: PALM/STORM). The company is entering into partnerships with major players in the pharmaceutical field: Sanofi, Astrazeneca, Evox Therapeutics, UK Cancer Research, etc.

Another actor, launched in 2010, is French company BioAxial. BioAxial was inspired by work done by co-founder and inventor physicist, Gabriel Sirat, and has raised a total of €6.9 million. In 2014, BioAxial collaborated with Nikon to develop new SRM and were acquired by Telight in 2019. The team’s technology has been implemented not only in academic settings like Institut Pasteur but also by industrial players like Sanofi.

Start-ups & biotech companies are starting to make their mark and acquire their share of the market. The price of the technologies is an important question but the handiness and user-friendliness of the software and technologies are criteria of interest for research structures that cannot afford the recruitement of new talent specifically dedicated to run SRM.

More advances are expected in the SRM field but these new, smaller players are already helping the widespread and routine use of SRM in translational and advanced research by simplifying the workflow, increasing the throughput and providing automation.

In a nutshell

The advent of new, simplified, less expensive benchtop SRM equipment is opening up new markets for a technology that has so far been limited to specialists. The innovation in the field comes through state-of-the-art technology developed in world class academic labs, spun out into start-up companies. These new players will steer the field to more applied research and routine applications. In parallel, the pharmaceutical industry is looking for more robust and simple technologies to decipher the mechanism of action of drugs at the molecular level. The fields of gene and cell therapy, as well as extracellular vesicules, are also in search of cutting edge technologies to control the quality of therapeutic products. As seen through partnerships initiated with new players, the pharmaceutical industry is actively looking for solutions and will soon be implementing the tech.

The new generation of SRM is coming and we’ll be there to share any new developments in this promising field!

Any questions?

Need a strategy for establishing and growing your business? Limited in capacity to implement marketing, sales and distribution channels? Whether you’re trying to find your ideal market, launch a product, or expand your existing business, get in touch with our team now, and experience the Novoptim difference.

Get in touch